Is driver pay abnormally high? Or returning to its pre-1980s normal?

In an enlightening interview with Yahoo! Finance, Eric Fuller, the CEO of U.S. Xpress shed light on the worsening driver shortage. Inflationary pressures impacting the industry “aren’t on the typical six-quarter cycle,” he said. Driver constraints are “about as bad as I’ve ever seen… I think maybe things have changed permanently.”

The transportation industry needs to reevaluate the way it thinks about the difficulty of attracting and retaining drivers. This has been a consistent problem since 2005. This year, we’re celebrating the driver shortage’s sixteenth birthday – that’s right, if it were a boy, it would be old enough to drive!

Can a phenomenon that has lasted for sixteen years really be considered a crisis? Or has the transportation industry never really grappled with the root causes of the driver shortage?

Pay is rising for all blue-collar workers

The COVID-19 pandemic has forced the service industry to spend more on employees. In July and August, Chipotle, McDonald’s, Walmart, Target, and CVS “have all announced moves to try to woo new workers and retain current ones,” according to CNBC.

In July, researchers announced that this is true for the majority of blue-collar industries. According to Bob Schwartz, Oxford Economics senior economist, “Over the last two months, (workers with just a high school diploma) received a median average annual pay raise of 3.7% compared to 3.3% for workers with a bachelor’s degree… In this job market, you don’t need a degree.”

Since February 2020, “average hourly earnings in the private sector were up by 6.6%. For leisure and hospitality jobs, up 7.9%. For retail jobs, salaries went up 8.6%.” In the post-COVID economy, drivers who want to leave the transportation industry have plenty of options.

Are driver wages artificially high in 2021 – or were they artificially low in the 80s and 90s?

For most of trucking’s history, driving was one of the best-paying jobs open to workers without college degrees. For drivers, these boom times lasted decades. Before they ended in 1980, the average trucker’s annual inflation-adjusted salary was $110,000.

Because of changes in government regulations, growing international trade, and technological advancements, driver salaries fell dramatically in the 80s and 90s. In this era, trucking executives became accustomed to bare bones employee costs.

Then, in the mid-aughts, salaries started to rise again. That generation’s executives, used to two decades of low pay, had never had to compete for drivers. They thought that increased salaries were an aberration and that the industry would quickly return to the “normal” of the 80s and 90s.

The questions those executives didn’t ask were: What if rising pay rates were a sign of the industry returning to its true normal? And what if real aberration had been the unusually long era of low pay that was about to end forever?

If driver pay won’t return to 90s lows, how can fleets maintain profits?

Today, driver salaries still aren’t anywhere near their 1980 peak. The average driver still only makes $47,130 per year – while working a 60 to 70 hour week. Now that other blue-collar professions are paying more (and young drivers hesitate to commit to a profession that self-driving cars threaten to eliminate) driver paychecks aren’t likely to get lower.

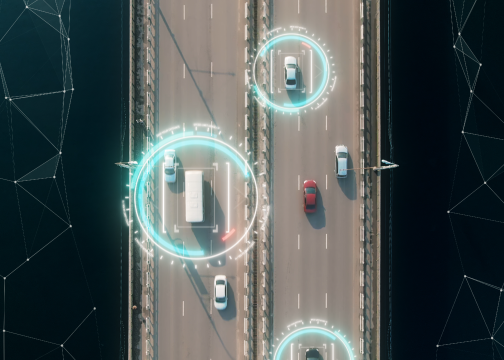

Fortunately, new technologies have eliminated much of the waste that used to burden fleets. Transportation professionals are finding they can do more work, faster, with smaller and more effective teams. Although drivers are increasingly expensive, the processes that keep fleets moving are leaner, cheaper, and more powerful.

Going forward, businesses will spend more money on drivers – but will still cut overall costs by adding fleet automation and AI to their organizations.

Learn how these new developments will transform 21st century fleets.

|