Fleets and the Ukraine crisis: How to prepare for supply chain disruptions

As the Ukraine crisis grows more intense, sanctions on Russia become more impactful. With the global supply chain still strained, these sanctions have the potential to impact the operations of US fleets.

The pandemic proved that global crises have hard-to-predict consequences. The US and the EU’s response to Russia’s invasion of Ukraine is evolving every day. Here’s what we know so far:

Fleets will need to watch for rising gas costs

In 2021, 7% of crude oil in the US was imported from Russia. If that supply is cut off, US oil prices could increase sharply. However, the US government currently has no plans to stop Russian energy exports.

Even though Russian oil will continue to come into the US, fleets should be prepared to pay more for gas. David Bernell, a public policy professor with Oregon State University, told Wyoming News, “There is a significant ‘fear premium’ that we all pay for crude oil, based on concerns that supplies may not be sufficient a few months out, so there are higher prices at the pump, regardless of what might be happening with the quantity of oil pumped on a given day.”

Disasters of all kinds, from wars to embargoes, tend to make oil prices spike. Fleets that want to prevent rising oil prices from taking a big bite out of profits should invest in fuel management technology.

The Ukraine crisis could keep vehicle prices high

The price of used and new vehicles has been high for quite some time now. Many factors have conspired to make it difficult to buy trucks, from quarantine’s impact on the supply chain to the more recent Canadian trucker protests. But the primary factor slowing auto production has been the long-term semiconductor shortage.

Some of the materials needed to manufacture semiconductors are manufactured in Ukraine. Cryoin, a neon gas refiner in Ukraine, ships most of its neon to the US. As a whole, American semiconductor companies source 90% of their neon gas in Ukraine.

Another potential choke point is palladium, a key component in catalytic converters. 35% of palladium in the US comes from Russia. Severe sanctions could make it more difficult for automobile manufacturers to source this material.

The conflict’s impact on semiconductor supplies won’t be immediate. After the pandemic’s disruption, American semiconductor manufacturers have diversified the sources of their supplies. But fleets that want to stay safe should do everything they can to keep their current vehicles in top-notch condition.

Cyberattacks could weigh down an already stressed supply chain

Cyberattacks were a growing crisis before tensions between Russia and NATO exploded. From 2013 and 2020, their number rose by 3,900%. Because the US and the EU are supporting Ukraine through sanctions, arms support, and political pressure, the Russian military might want to find an appropriate way to respond. According to Beth Sanner, the former deputy director of US national intelligence, that response is likely to take the form of cyberattacks.

Russia has a record of targeting big supply chain companies. In 2017, a Russian cyberattack took Maersk, the world’s largest shipping line, “completely off the grid for roughly a week.”

While Russia’s 2017 attack didn’t have a huge impact on the supply chain as a whole, today’s environment is more fragile. Supply chains have only started to recover from the pandemic. A similar attack in 2022 might cause a more harmful disruption.

Comprehensive monitoring protects your fleet against uncertainty

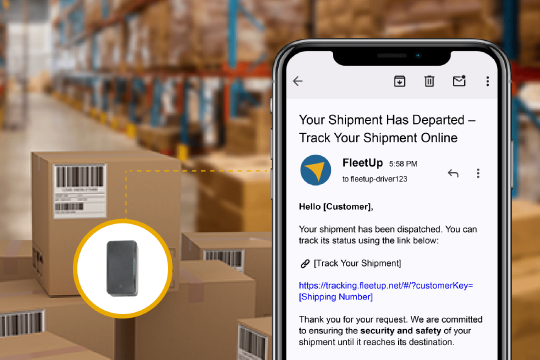

Between the pandemic and Russia’s invasion of Ukraine, it’s clear that unanticipated events can have huge impacts on the global economy. The best way to prepare for uncertainty is to get real-time insight into the status of your operations. No fleet software provides better clarity than FleetUp – prepare your fleet for tomorrow’s uncertainties today.

|